Make a qualified donation to CEF, and avoid paying state income tax.

Financial advisors, accountants, bankers, attorneys and tax specialists should be aware of a successful charitable program that helps clients keep more of their money while accomplishing worthy philanthropic goals.

CEF offers 70% Kansas state income tax credits to individuals, businesses, banks, insurance companies and other financial institutions in exchange for donations to CEF’s Tax Credit Scholarship Program for Low-Income Students. Banks and C-corps may get additional tax benefits, and all bank donations qualify as Community Reinvestment Act donations.

These tax credits are still available for 2022, and taxpayers can contribute up to $500,000 per year. The tax credits never expire, and can be used in subsequent tax years. The pool of available tax credits for this program is limited to $10 million per year statewide, and credits will go quickly in 2022.

Why CEF tax credits are so desirable

Donors to CEF’s tax credit scholarship program are helping students in poverty achieve a 100% graduation rate and prepare to contribute to the local community workforce.

For advisors whose clients are interested in mitigating state income tax,

consider these benefits:

- tax credits are more favorable than tax deductions because they actually reduce the tax due, not just the amount of taxable income

- donations support CEF scholarships for students living in poverty to access education in Catholic schools that consistently produces a 100% graduation rate

- contributions can be made via cash, stock gifts, qualified IRA gifts, and other gift types

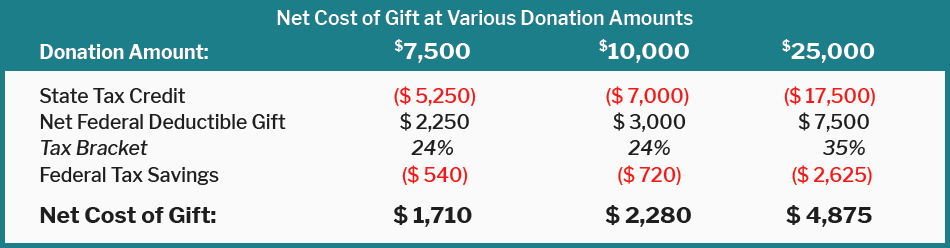

- qualified donations receive a 70% KS income tax credit and may qualify for deducting the remaining 30% on federal tax returns. This combination may allow taxpayers to recoup 75-80% of their donation. (See example tax savings scenarios below.)

A simple way to reduce clients’ tax liability while providing a social good

- few tax strategies have the impact of 70% state tax credits, especially in Kansas

- few charitable gifts have the impact of scholarships that follow the child through K-12, college-prep education at dual-accredited schools that are producing a 100% graduation rate from urban and rural communities alike

- CEF Tax Credit Scholarships are saving Kansas taxpayers millions each year without any negative impact on the K-12 public school system

- clients are increasingly seeking philanthropic solutions that yield tax benefits, and for clients that prioritize faith-based-, education-, or poverty-related charitable giving, CEF’s Tax Credit Scholarship Program meets all three criteria

- the process is very simple – just request our one-page application form here.

We'll be happy to provide materials for you to share with your clients, or join you for a discussion or webinar with your clients. To learn more or secure your 70% KS income tax credits today, please contact Libby Knox, CEF Senior Director, Development, via email or call (913) 721-1572.

CEF is a 501(c)3 nonprofit organization and Kansas state-approved scholarship granting organization. Note that there are a number of taxpayer specific factors that could impact these results. The Catholic Education Foundation does not provide tax, legal or accounting advice. Any illustrative material is prepared for information purposes only. Potential donors should consult their own tax, legal and accounting advisors. Some restrictions apply; contact us for details.